Following the Israeli invasion of Lebanon in 1982, Hezbollah established Al-Qard Al-Hassan Association with the proclaimed aim of providing social services to the local communities affected by the period’s hardships, through time-specific loans.

Since then, the association has grown into a massive financial institution, spread across various areas of Lebanon in over 30 branches that operate much like conventional banks do, despite it being registered as a charity.

What is Al-Qard Al-Hassan?

The idea of the Association of Al-Qard Al-Hassan (the benevolent loan) is based on the Islamic concept of the same name. The concept describes a form of an altruistic, interest-free loan provided to people who need it, essentially for the sake of supporting them in their time of need, rather than for the personal gain of the lender.

With that in mind, when the Association was established in 1980s war-torn Lebanon, it was officially registered as a charity and licensed as such by the Interior Ministry.

The announced goal was “helping people through providing them time-limited loans backed by the Association to solve some of their social problems.”

The Association has since maintained that its funding comes from donations – religious and otherwise – in addition to subscriptions, memberships, and contributions from the public.

However, it has long been scrutinized for its direct connection to Hezbollah, which is believed to use the Association to funnel money directly to fund its operations while evading taxes using its charity status.

Accounts and Memberships:

At its core, Al-Qard Al-Hassan Association has 2 basic types of accounts: “Participation” and “Contribution.”

Participation Account:

Introduced in 1998, the Participation Account is the primary membership, which unlocks the Association’s financial services, most notably, its lending services.

To take a loan through Al-Qard Al-Hassan, one must have an active Participation Account. The account incurs a premium of at least 10,000 Lebanese pounds, paid monthly and without cessation.

Through this account, in addition to benefiting from the Association’s services, a member can help other borrowers by guaranteeing them using the total balance that he or she has contributed through his or her membership.

The longer a member has been with the Association, the larger the loans that he or she can take.

According to the Association, the Participation Account aims to “consolidate the ties among the association and loan seekers, urge the loan seeker to save money even in little amount, and encourage them to contribute to the process of lending others.”

The undeclared purpose of the monthly membership is believed to be helping the coverage of the Association’s costs, in addition to acting as an insurance premium.

Contribution Account:

The Contribution Account type targets what the Association calls “well-off individuals,” who would be interested in providing financial support to it and its borrowers, “easing some of the social problems and burdens, which loan seekers suffer from…”

A Contribution Account holder can contribute a minimum sum of $500 to a member individual or group of their choosing, under the Contributor’s conditions, provided that the money is exclusively used to pay out loans for borrowers.

A Contributor may freely withdraw his or her donated funds that are not allocated for guaranteeing a loan at any given time.

In addition to traditional loans with various conditions and pawns – gold and otherwise – Al-Qard Al-Hassan Association offers other forms of loans through “donation boxes.”

A group of people from the same village, neighborhood, business, or family can contribute to these “donation boxes” with a monthly fee, similar to that of the Participation account, in exchange for variable loaning opportunities.

The Hacking of the “Benevolent Loan”

The recent security breach that Al-Qard Al-Hassan Association suffered from at the hands of a self-proclaimed hacker group uncovered to the public significant data, including account-holder information and general figures on the Association’s assets.

But, perhaps the most notable of the revealed information were the documents that, according to the group, prove that the Association does, in fact, have accounts in various banks in Lebanon, which several banks have denied nonetheless.

This is significant because it contradicts the claims that Hezbollah‘s Secretary-General, Hassan Nasrallah, has made about the Association having no such accounts in any banks.

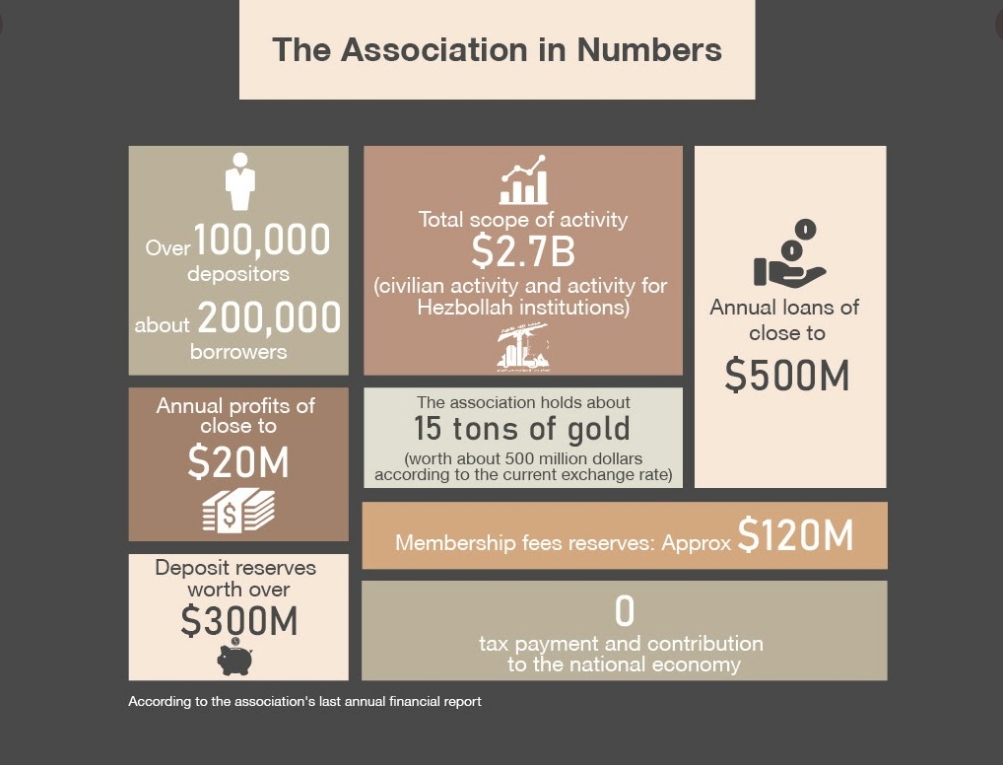

Despite it being blacklisted and sanctioned by the United States in April 2016, the Association’s activity is reported to have grown significantly ever since, with the value of its disbursed loans increasing from $371 million in 2016 to $476 million in 2018, for example.

More recently, the Association introduced ATMs to some of its branches, further expanding and facilitating its services as a major financial institution.

It’s important to note that the U.S. Treasury and Trade Department has designated Al-Qard Al-Hassan Association as an entity that aids terror funding (Hezbollah is a U.S.-designated terrorist organization).

Therefore, the recent leaks might lead to serious repercussions for Lebanese banks that are ultimately proven to have conducted transactions with the Association, not to mention potential similar consequences on the individual borrowers and account-holders whose identities have been revealed.