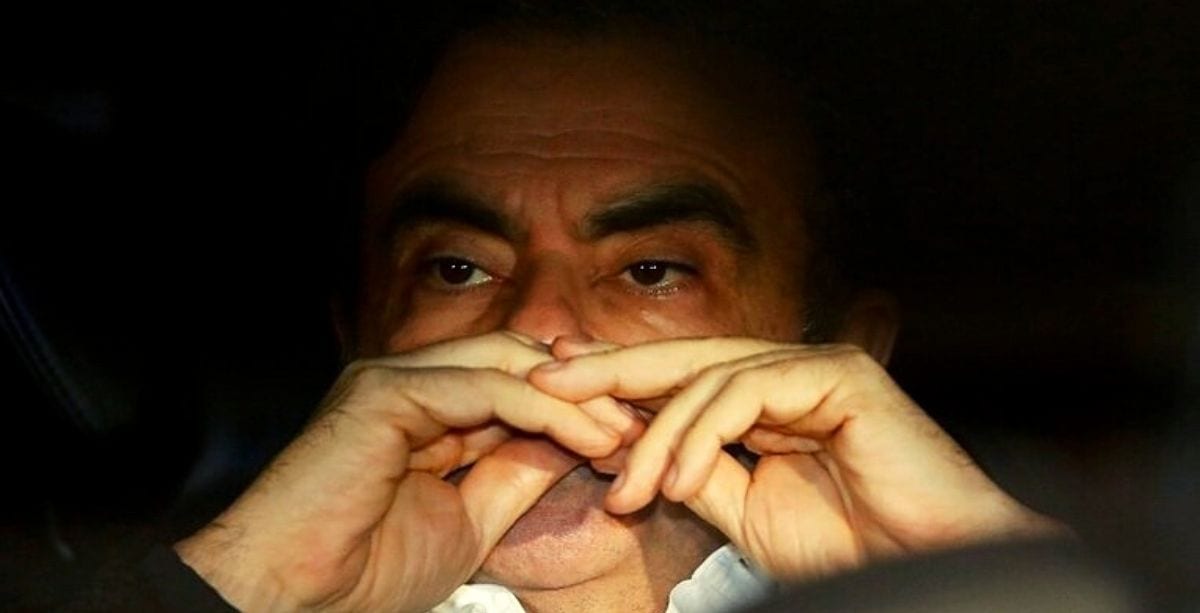

When the alliance architect and head Carlos Ghosn was arrested in Japan in 2018, things went downhill quickly. Since then it has been one bad quarter after the next.

~ Thom Taylor, MotorBiscuit

Carlos Ghosn left Nissan-Renault-Mitsubishi Motors as an unstable alliance with an unclear future. Having suffered great losses over the past few quarters, all three automakers are left with no choice but restructuring.

Things were going very well for the dominant Alliance a few years ago. In both 2017 and 2018, the member companies collectively sold 10.6 million light commercial vehicles; the highest figure in both years.

However, the series of dramatic events that began unfolding after the first arrest of Carlos Ghosn in Japan in November 2018 has greatly damaged the Alliance, which has since seen several leadership changes and strategy shifts.

The shaky trajectory that the Nissan-Renault-Mitsubishi Alliance has been tracing in the past months has given rise to speculations that it may be drawing its final breaths. New information even suggests this may even happen this week.

Nissan/Renault/Mitsubishi Alliance May Be Gone This Week.

~ Thom Taylor, MotorBiscuit

Leadership collisions

It’s no secret that a debilitating leadership vacuum was created when Carlos Ghosn was pulled from his position after his remarkable 2-decade-long run as the “Le Cost Killer” CEO/chairman of Nissan, Renault, and Mitsubishi Motors.

Post-Ghosn, a series of leadership changes in the aforementioned companies amplified the aura of uncertainty that surrounded all of them.

The Alliance members’ bumpy strategies are one reason for the enormous losses that they’ve recently had to endure.

The untimely coronavirus (COVID-19) pandemic – which has caused worldwide car sales to plummet – coupled with Renault recently facing a serious existential crisis, is one of the major threats that could dissolve the nearly 20-year-old alliance.

Renault may disappear

The survival of Renault is undoubtedly essential to the survival of the Alliance. Hence, it’s safe to say that the French Finance Minister’s recent remark about the company points toward a possible disintegration.

“Renault can disappear,” minister Bruno Le Maire has said, indicating that the French carmaker is in “serious financial difficulty.”

In 2019, Renault saw its worst performance in a decade, and the coronavirus situation has not made business easier.

In an attempt to recover, the company is now seeking a loan amounting to 5 billion euros from the French government. If that loan is to be cashed, however, France, which owns 15% of Renault, wants to see some conditions met first.

Renault must, among other things, keep workers and production in France and agree to produce more eco-friendly vehicles in the future. If Renault does not comply, it may trigger its own collapse.

But Renault is not the only member of the Alliance that’s facing dire challenges. As reported by CNN Business, Nissan is preparing to reduce its global capacity by 20%, cut its workforce by 20,000, and shutter some of its plants.

Nissan‘s operating profit has fallen by a massive 83% since this time last year after suffering immense profit declines over the past 4 quarters.

The Alliance’s fate

Amidst the chaos, in January this year, the Alliance denied the rumors that there was a split-up on the horizon.

This did not stop similar speculations to emerge in the following months, especially after the COVID-19 situation gave the global car market a serious beatdown.

The Post-Ghosn strategies that each of Renault, Nissan, and Mitsubishi Motors adopted have cost them billions of dollars.

Despite that, their alliance, of which Carlos Ghosn had been founding chairman and CEO since 1999, does not appear to be going anywhere anytime soon.

On Wednesday, May 27th, the Nissan-Renault-Mitsubishi Motors Alliance announced that its three members will be deepening their ties by implementing new operational strategies, including having each take the lead in the different regions of the world.

The struggling companies will be grouping their production together where possible while focusing “on efficiency and competitiveness rather than volumes,” the leader of the Alliance and head of Renault, Jean-Dominique Senard, has declared.